The Silent Wealth Erosion

Why your annual fees could be costing you a fortune

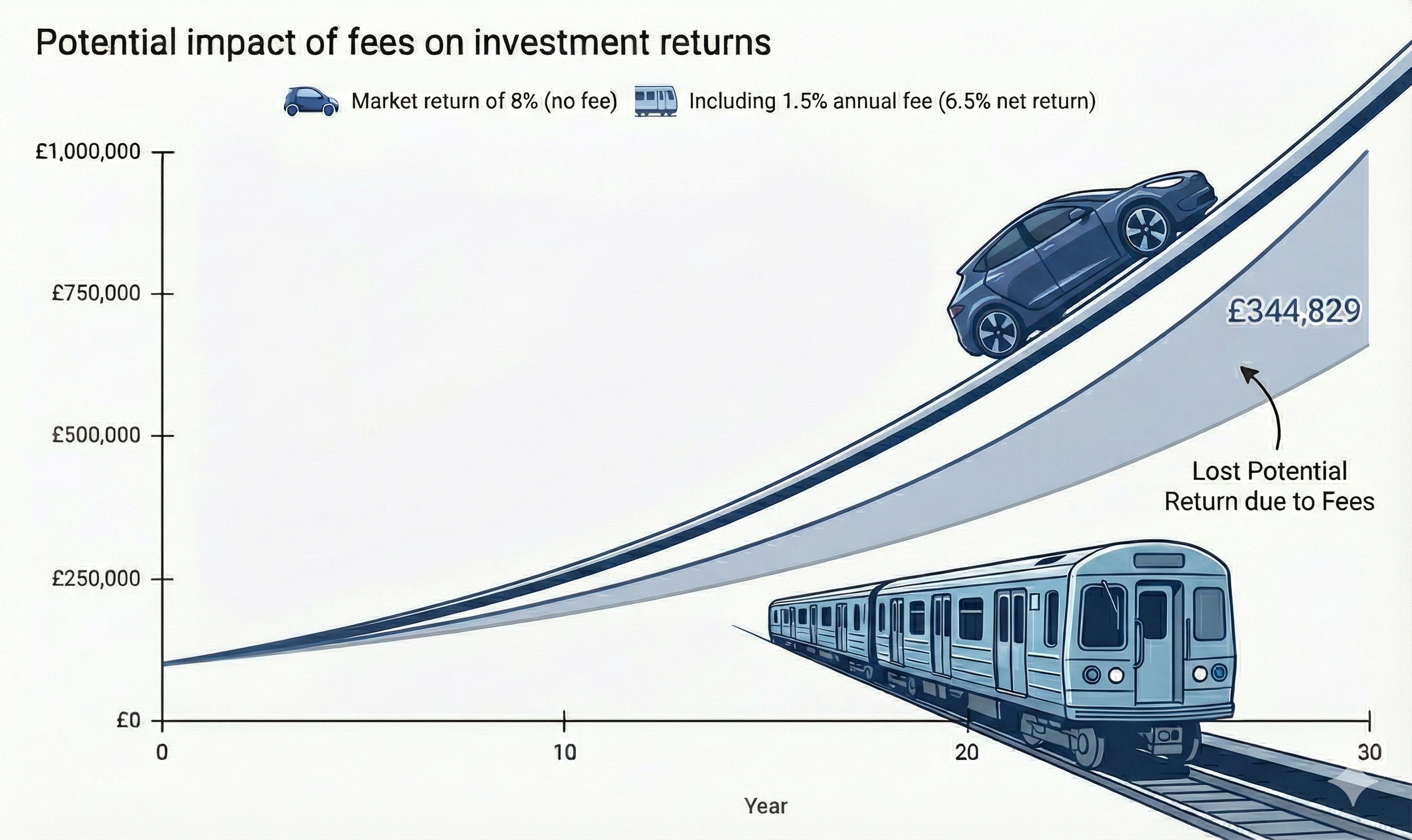

Famous investor Warren Buffett once said: "Wall Street is the only place that people drive to in a Rolls-Royce to get advice from those who take the subway."

When planning for your financial future, it’s natural to obsess over investment returns. However, in the pursuit of the best results, investors often overlook one factor they actually can control: costs.

A seemingly ‘small’ annual percentage fee might feel inconsequential today, but thanks to the power of compounding, it can capture a surprising amount of your future wealth.

The Investment Fee Iceberg

The biggest mistake many investors make is assuming the fee they pay their advisor (typically quoted at around 1%) is their total cost.

Unfortunately, the total fees associated with your portfolio are often structured like an iceberg. The advisor’s management fee is just the visible tip. Below the surface lies a layered structure of costs that are continuously deducted from your investments, regardless of whether the market goes up or down.

To understand the true cost to your portfolio, you must assess the "Total Cost of Ownership," which includes:

The Headline Management Fee: What you pay the advisor or wealth manager for their advice and service.

Underlying Fund Costs (OCF/TER): If your portfolio is invested in funds, those funds have their own internal management teams, marketing budgets, and administrative costs. These are expressed as an Ongoing Charges Figure (OCF). In active management, this can frequently add another 0.75% per year to your overall cost drag.

Platform and Custody Fees: The cost paid to the investment platform that holds your assets and administers the accounts.

Transaction Costs: The often-invisible friction of buying and selling. Every time a fund manager trades a stock, there are commissions, taxes, and "bid-offer spreads" (the difference between buying and selling price) to consider. High portfolio turnover results in higher hidden costs.

When you stack these layers, a portfolio that looks like it costs 1% can easily cost 2.5% or more annually.

Compounding in Reverse

Why does an extra 1% or 2% matter? Because of compound interest. Albert Einstein reportedly called compound interest the "eighth wonder of the world" - money making money on itself.

Fees are the ‘anti-wonder’. They are compound interest working against you.

Any sum paid in fees is not just gone today; it is also money that can never earn a return for you in the future. Over decades, this "opportunity cost" creates a massive divergence in potential long-term wealth.

As the chart above illustrates, seemingly small percentages lead to the erosion of long-term wealth. In a scenario with an 8% gross market return over 30 years, a seemingly small 1.5% fee drag nearly halves your potential investment growth.

What should you do?

You cannot control what the stock market will do next year. But you can control the efficiency of your portfolio.

Ask for a full, written breakdown of every single cost — not just the headline fee.

Compare that number against simple, transparent index funds or ETFs (total cost usually 0.20–0.60%).

Remember: paying more does not guarantee better returns. Decades of data show most active managers fail to beat their benchmark after fees.

Your money needs to work hard for you, not for a chain of intermediaries. Every 0.5% you save in unnecessary fees is effectively a risk-free, tax-free return — and it compounds over time.

The Bottom Line

The goal should not be to find the "cheapest" solution, but the most efficient one. Individuals should be happy to pay a fair fee for high-quality advice and investment services. However, it is equally important to have a clear grasp on the true cost associated with your portfolio. By eliminating unnecessary costs where possible, you can go a long way to enhancing your long-term returns, before even considering what you’re actually invested in.